Contents:

The IRS allows you to deduct half of your self-employment tax. It won’t reduce the amount of SECA tax you owe, but it will help to reduce your income tax liability. Being an independent contractor comes with a lot of perks, but it also comes with a different set of tax responsibilities. When you work for a client, you are paid your full fee with no taxes withheld.

- If that’s the case, you could take a crack at filing taxes yourself.

- Feel free to schedule a consultation if you need further guidance.

- If you’re also eligible for a premium tax credit, only the part of the premium you pay yourself is deductible.

- No one likes a tax audit, and there are numerous tales about what will provoke one.

- Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Fees for other optional products or product features may apply. On the other hand, you’re not an independent contractor if your payer has the legal right to control how you do your work — even if you’re generally provided the freedom of action. Independent contractors are otherwise referred to as freelancers or 1099 workers. The latter term stems from the name of a form payers use to report the compensation paid to contractors (which we’ll explain in more detail later).

Each 1099 form must be hand delivered or sent in the mail on or before February 1. If the employer fails to do so, there could be a penalty of up to $250. If the employer files the 1099 through postal mail, form 1096 and Copy A of each 1099 must also be sent on or before February 29. However, if the employer is filing over the computer, he or she has until the end of March. Employers should retain Copy C for their own records as a precaution in case the IRS needs any more information. Non-compete agreements state that the contractor cannot compete with the client in the same field.

Contractor Agreement

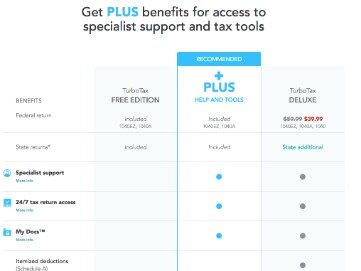

If you have a straightforward purchase journal situation with few deductions, then it’ll be less expensive to use a tax filing software yourself. When you’re looking for unique skills or trying to fill gaps in job responsibilities without hiring a full-time employee, independent contractors may meet your needs. Employers that outsource some of their functions must know how to file tax forms for independent contractors. If your business uses the services of this type of worker, you should be familiar with independent contractor tax forms and their filing requirements. Working with foreign independent contractors provides many advantages for growing businesses.

Understanding Workers’ Compensation Insurance For Independent … – ValueWalk

Understanding Workers’ Compensation Insurance For Independent ….

Posted: Wed, 12 Apr 2023 17:09:20 GMT [source]

The IRS Form 1099 is crucial in ensuring you fill out your tax return forms with accurate information, so you do not under or overpay taxes. As an independent contractor, you need to understand what exactly this form is and how to use it. This form is for US citizens, and your contractors will use it to provide their Tax Identification Number as well as let you know whether they are incorporated. For the IRS, this form acts as written proof and confirmation of your independent contractor’s business name and ID. Their signature on this form helps your business to sidestep any responsibility for the contractor’s tax requirements. In fact, once these forms are filled in, your organization carries no liability for independent contractor taxes whatsoever– even if the worker misrepresents their location or status.

Independent contractor tax deadlines

Most state programs available in January; software release dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Collect the required information about the contractor through Form W-9 (See Step #1).

Before you report income from this form, make sure you reconcile it with the 1099-NEC to avoid double reporting. The scoring formulas take into account multiple data points for each financial product and service. Sally Lauckner is an editor on NerdWallet’s small-business team. She has over a decade of experience in print and online journalism. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content.

It’ll make it even easier to transfer your 25 to 30 cents for every dollar you earn to pay for taxes. Estimated payments are required for individuals, including sole proprietors only if you expect to owe $1000 or more when your return is filed. One of the most frustrating aspects of being an independent contractor is having tax season roll around and feeling bewildered by all that must be done. You might feel overwhelmed about possibly being hit with steep penalties and fees . Or perhaps, you’re living your dream as a US citizen and living full-time in Asia. Perhaps you are abroad and you are earning an income as an independent programmer.

Therefore, the employer should consider withholding based on where the service was performed, and whether tax treaty exemptions can be applied. If the incorrect information submitted on Form W-9 results in the erroneous information provided on Form 1099-MISC, the IRS may notify you to contact the contractor to request the corrected specifics. If the contractor does not respond, this may force you to start backup withholding from payments to the independent contractor. There are a number of ways to pay your estimated taxes, but the most popular one is through the IRS’s Electronic Federal Tax Payment System . EFTPS allows business owners to pay estimated taxes in sort of a pay-as-you-go system, with weekly, bi-weekly, and monthly installment options.

If you’re also eligible for a premium tax credit, only the part of the premium you pay yourself is deductible. The eFile.com tax app will guide you through this when you prepare and eFile your taxes. Expected to be permanent (or at least relatively long-term). The services you provide are a key aspect of the regular business of the company. Therefore, unlike the 1099-NEC that the client fills and sends to the contractor, the W-9 form is filled by the contractor and returned to the client/business. Unlike the 1099-NEC form that originates from the clients, 1099-K will come from third-party payment service providers.

Independent contractor tax forms for employers

Schedule SE form calculates the amount you have to pay in Social Security and Medicare taxes. You’ll use the income or loss calculated on Schedule C to determine what you owe. Remember, clients that paid you less than $600 don’t have to issue one — and some clients may not send one, even though they’re supposed to. Max Freedman is a content writer who has written hundreds of articles about small business strategy and operations, with a focus on finance and HR topics. He’s also published articles on payroll, small business funding, and content marketing.

You can file a Schedule C-EZ form if you have less than $5,000 in business expenses. Independent contractor status can apply regardless of how your business is structured. You could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company)LLC) or adopt a corporate structure.

Even though countries have different standards for testing a work relationship, they tend to look similar. The goal of these standards is generally to examine how much control the company has over the individual it hires as an independent contractor. If a US court or the IRS determines a person your company hired as an independent contractor is, in fact, an employee, you can face liabilities for not meeting the requirements of employment. If the performance of your services is controlled by the payor, you are not an independent contractor. The misclassification of workers at the time of hire may put you on the hook for paying employment taxes for that worker down the line.

To illustrate how deductions work, let’s look at an example of a freelance dog groomer. You also need to choose your filing status from the drop-down menu (e.g. married, filing jointly). This way, the calculator can determine whether the Additional Medicare Tax applies based on the above criteria, and take it into account. Typically, when a contractor gets a Form 1099 from a client, some of those blue boxes are going to be filled in—with the contractor’s name, address, the TIN they entered on Form W-9, and other info.

Case #4: A US company pays an independent contractor who is a US citizen living in another country

Leave box 4 blank, since you do not withhold taxes when you pay independent contractors. On the 1099-NEC contractor tax form, mention the non-employee compensation in Box 1. List your business’s Taxpayer Identification Number or TIN as payer’s TIN. Plus, mention your firm’s name, address in the top left section of the 1099 contractor form. Here’s what information you need to provide in the 1099-NEC independent contractor tax form.

The contract should clarify that the contractor has the freedom to set their schedule, use their tools and equipment, and deliver the work on their terms. You should only collect Form W-9 once the contractor starts working for the company. If the independent contractor’s information changes, they must submit an updated Form W-9. Please see the policy for full terms, conditions and exclusions.

Businesses must have independent contractors complete Form W-9 (“Request for Taxpayer Identification Number and Certification”) before beginning work. The document is essentially the equivalent of Form W-4 but for independent contractors. The document confirms the contractor’s name, address and taxpayer identification number in the form of either a Social Security Number or an Employee Identification Number . This information is needed for a business to fill out and issue Form 1099-MISC. However, you must exercise sound judgment when classifying workers and thereby in distinguishing whether a worker is an employee versus an independent contractor.

These plans allow for deductible contributions, with qualified withdrawals taxed at your ordinary income tax rate in retirement. The 1099-NEC form originates from clients and business owners that pay an independent contractor or freelancer wages equal to or more than $600. The IRS makes it mandatory for businesses to fill and send the form to non-employees they establish an independent contractor relationship with. However, once you hit that $600 mark, or if you’re planning on forming a longer-term relationship with your independent contractors, you’ll be responsible for reporting your payments to the IRS. You do this for every independent contractor individually, using Form 1099-NEC, which as of 2020 has taken over from Form 1099-MiSC. In a growing gig economy, it’s becoming increasingly common for companies to rely on freelancers, agencies, and independent contractors to complete vital roles across the business.

An electronic version of the form may also be included with your tax software. The independent contractor should complete the W-9 form and return it to the business with other requested information. Form 1099-NECis used by payers to report payments made in the course of a trade or business to others for services. Every Form 1099 includes the payer’s employer identification number and the payee’s Social Security (or taxpayer-identification) number. The IRS matches nearly every 1099 form with the payee’s tax return. Taxpayers don’t include 1099s with their tax returns when they submit them to the IRS, but it’s a good idea to keep the forms with your tax records in case of an audit.

How to File Form 1099 Online?

Contractors can claim it on line 14 of Schedule 1 in IRS Form 1040. As mentioned, a core feature of independent contractor taxes is that the independent contractor has responsibility for paying their own taxes. But this doesn’t mean that they pay it all at the end of the tax year. In this guide to independent contractor taxes, we set out the key matters that both the independent contractor and their client should be aware of when managing independent contractor taxes.

Dispute resolution clauses are about resolving disputes when they arise. When multiple countries are involved in the work relationship, selecting governing laws and a forum in advance can save a great deal of time and resources in future litigations. Parties can also choose to have alternative dispute resolutions, such as mediation or arbitration, instead of lengthy litigations. Make sure to determine if the contractor’s country of origin requires the use of local laws and courts in work agreements. Here are other benefits of hiring an independent contractor. In Part II, he’ll subtract or deduct all of his business expenses from his income.

Coffee County Drug Court Foundation found to have ‘major mismanagement’, per Comptroller’s report – WKRN News 2

Coffee County Drug Court Foundation found to have ‘major mismanagement’, per Comptroller’s report.

Posted: Fri, 21 Apr 2023 20:45:53 GMT [source]

As a self-employed individual, you are responsible for paying income taxes and self-employment taxes. Self-employment taxes are paid in addition to regular income taxes. Self-employment tax is made up of Social Security and Medicare taxes. Taxes paid via quarterly estimated payments and paid with tax return if more taxes are owed. Learn about the Pandemic Unemployment Assistance program and unemployment benefits for self employed taxpayers as a result of the second stimulus payment package.